Running payroll is a challenging task for small business owners as well as freelancers. One of the ways to be legal is to use a check stub generator.

When choosing one for their business, people often get confused between a check stub generator and manual payroll. So, which option is better for your business?

In this guide, we will break down the key differences between them, and by the end of this blog, you can easily choose which is the best fit for your business.

What is a Payroll Stub Generator?

A payroll stub generator is a tool that helps employers automate the process of generating pay stubs for employees and freelancers. This allows users to insert employees’ data, earnings details, and deductions. The tool automatically calculates the taxes and creates a professional payroll that details the employees’ earnings, withholdings, and net pay.

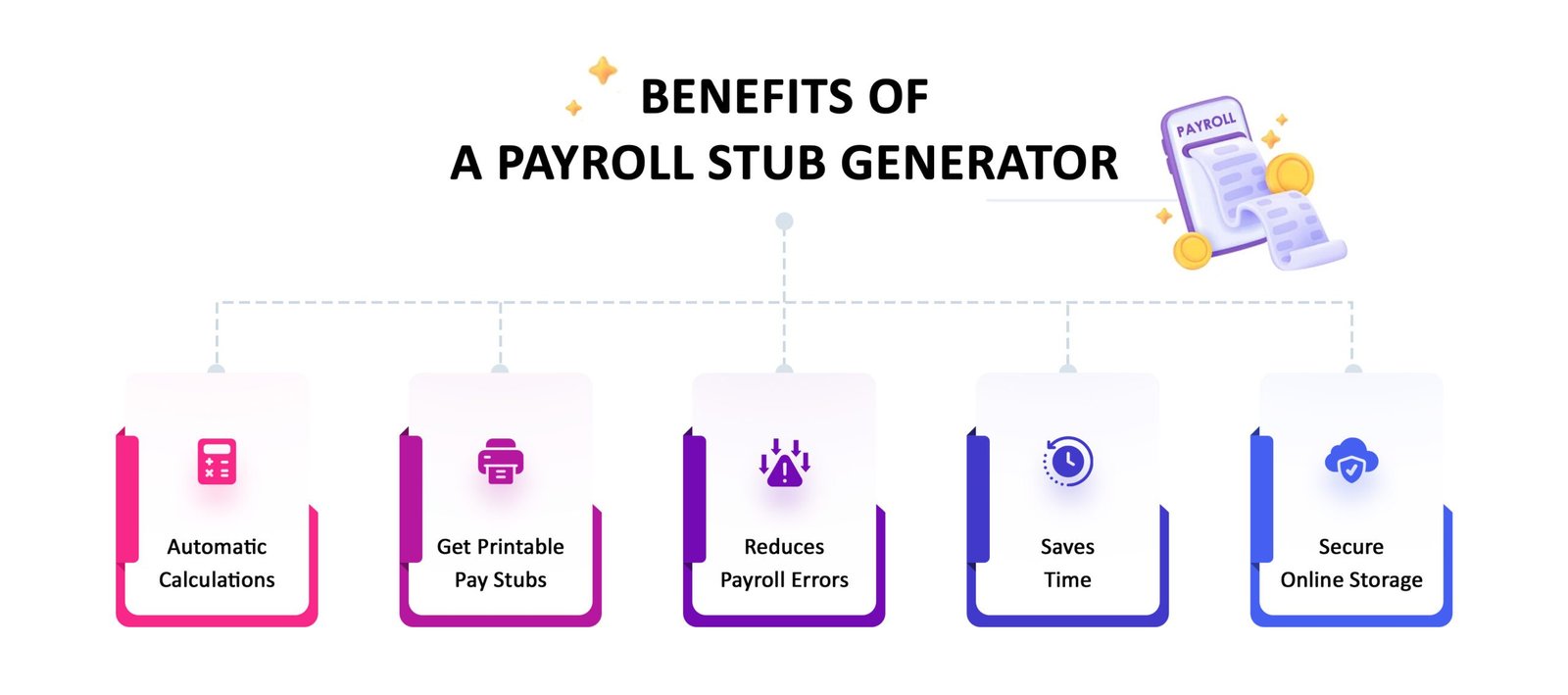

Benefits of a Payroll Stub Generator

The main benefits of a payroll stub generator are as follows:

- Automatic calculations

- Get printable pay stubs

- Reduces payroll errors

- Saves time

- Secure online storage

What is Manual Payroll?

Manual payroll means that employee salaries are handled without the assistance of any automated systems. In this case, employers have to monitor the hours employees have worked, figure out the gross pay, manually withhold taxes and other deductions, and pay employees either by checks or bank transfers. Additionally, all the records have to be kept and managed manually for the purposes of compliance and references.

Benefits of Manual Payroll

The main benefits of manual payroll are as follows:

- Low startup costs

- Great control and flexibility

- Customization

- Reduce dependency on technology

- No training required

Check Stub Generator vs. Manual Payroll

| Features | Free Payroll Check Stub Generator | Manual Payroll stub generator |

| Accuracy | Reduces error | High risk of human error |

| Easy to use | User-friendly | Time consuming |

| Tax compliance | Automatic updation | Manual calculation |

| Cost | Free to use | Free to use |

| Record keeping | Digitally | Manual files |

| Best for | Small business with few employees | Freelancers & Startups |

Both manual processing and the use of a digital check stub generator have their own benefits when it comes to payroll management. Payroll in a manual way may allow more oversight for a very tiny company, but in such cases, it is frequently susceptible to mistakes, time-consuming calculations, and various compliance-related issues.

Moreover, a check stub generator free not only simplifies the whole process but also stays accurate in deductions and net pay and saves a lot of time, which can be used for the further growth of the business. For a great number of companies, the decision of going digital is the most rational one.

Ready to simplify your payroll process, keep everything in line with regulations, and create professional pay stubs right away?

Try our free payroll stub generator today and discover how easy payroll can be!

Best Paycheck Stub Generator For Your Business in 2025

1- Paystub generator free:

The Paystub Generator Free Tool is a user-friendly, time-saving tool that allows users to generate pay stubs that look professional in just a few minutes and without the need for a subscription.

The process starts with users selecting a free pay stub template and entering employer/employee info such as pay frequency, earnings, wages, deductions then checking their stubs with built-in error checking.

The stub is free to download and can the stub either by download or email, all in their own secure and customizable environment supported by 24/7 customer service.

2- Stubcreator:

StubCreator is a simple-to-use website that generates pay stubs online designed for small businesses, freelancers, gig workers, and self-employed individuals. It is a great tool that avoids the use of manual calculations and makes the payroll documentation process easy and quick.

Users can enter information such as the frequency of pay, YTD earnings, and deductions, and then they can add a logo, pick a template, and preview and download their professional pay stubs right away.

The first stub is free or $4.99 off can be used, and email delivery is included. The company is all about accuracy, legal compliance, data security, customer support at any time, and free revisions, which is a very convenient and reliable solution for income proof documents.

3- Free paycheck creator:

FreePaycheckCreator.com is a great tool that gives you the ability to create your paycheck by using the payroll generator in just a few minutes through a simple and intuitive interface. This is an excellent solution for small businesses, freelancers, and self-employed individuals.

To create their own PDF pay stubs of any type, users normally fill in the blanks with information about the company, employee, period of work, earnings, and deductions, and the platform will make the calculations automatically and correctly; the first stub is usually a freebie, and the offer extends to printable templates, 24/7 support, breakdown of the pay.

4- Online paystub:

Online-paystub.com is a simple online tool that allows users, including small business owners, freelancers, and independent contractors, to create a professional pay stub in a very short time (usually less than a minute) for a flat fee of about $5.99 per stub (frequently with deals like buy one, get one free).

The steps are filling in the pay-related information (e.g. company and employee names, YTD earnings, SSN), checking the stub, and getting the final version via email—complete with the calculations done automatically, nice designs, customer service at any time of the day, and also the options for resending or downloading the stub.

5- Stubbuilder:

Stubbuilder.com is an online pay-stub and check-stub generator that is made for creating accurate, customizable, and quick pay stubs by freelancers, small business owners, contractors, and employees and even some related forms like W-2 and 1099-MISC—at a fraction of the time and cost.

Its simple user flow consists of three steps: put in employer/employee and payroll info, check the stub, then download or get it by mail after payment, usually starting at special rates like $4.99 per stub.

FAQs

1.Which is more accurate: Check Stub Generator or Manual Payroll?

Check stub generator are automated and consist of various functions, among which one is a tax calculation. They help in deducting the correct amount from your income and thus greatly reduce the risk of mistakes that usually occur when people do their calculations manually.

In particular, as the complexity increases, manual systems become more and more susceptible to errors of calculation or omission of deductions.

2- What’s more cost-effective – stub generator or manual payroll?

A pay stub maker is usually less expensive than handling payroll manually. Stub generators lower the need for experts in payroll, cut errors that can be costly, save time through the automation of calculations and pay stub creation.

On the other hand, manual payroll is a process that requires a lot of labor and is likely to have errors, compliance risks, and additional costs in the form of penalties. In the long run, manual payroll may be more expensive, and stub generators will be the ones that bring the most savings for small to medium-sized businesses that decide to take the accurate financial route.

3- Is keeping records digitally a better practice?

Paycheck stub generator free provides secure, digital, and easily accessible records. This is better than the clutter and risk of losing information associated with paper or manual systems.

4. Can freelancers and self-employed people benefit from a stub generator?

A pay check stub generator helps freelancers and self-employed individuals. It boosts professionalism, simplifies record-keeping, ensures accuracy, and aids in tax compliance. This makes it a valuable tool for managing finances effectively.

5.Why do businesses switch from manual payroll to a stub generator?

Switching to stub generators helps businesses improve accuracy. It also saves time and money, keeps them compliant, and improves employee experience compared to manual payroll.

Key Takeaways

If the staff size is extremely small, the business owner might be able to manage payroll on their own, but in that case, they will miss out on the accuracy, efficiency, and confirm that a check stub generator provides them with pay stubs. Initially, a free pay stub template could be very helpful; however, if the company aims at leading a stable growth path, employers should opt for automated payroll solutions.