Payroll is a very risky and daunting task, and that’s why accuracy is needed. That’s why creating a paystub is also an error-prone task for freelancers, small business owners, employees, and even independent contractors. As technology is evolving and more than 61% USA adults are using AI, then why not an AI paystub generator?

The free AI paystub maker is an innovative, modern solution created to make free paycheck stubs fast, accurate, and hassle-free with just a few clicks from any user without prior payroll experience required.

In this blog, we will explore what an AI paystub generator free tools are, its inner workings, its advantages, and why it has become such an invaluable tool for fast and accurate paystub creation.

What is an AI Paystub Generator?

An AI paystub maker is an advanced online tool that uses artificial intelligence to automatically and professionally format paystubs for employees. Instead of manually making the paystub with the salary calculator is cumbersome. For that, you need to use spreadsheets, or documents with salary calculators and then make a paystub by own.

However, automate paystub generator and, more than that, an AI check stub generator can help to produce accurate paystubs instantly. The AI paystub generation success demonstrates how technology is revolutionizing payroll; helping users save time while eliminating errors instantly when creating paystubs instantly.

Users looking to generate accurate AI paystubs simply need to enter basic information, including employee/contractor details, business information, pay rate or salary, work hours, and applicable deductions into an AI payroll system, which then analyzes this data, applies payroll calculations, and organizes everything into a neat paystub format.

How Does an AI Paystub Generator Work?

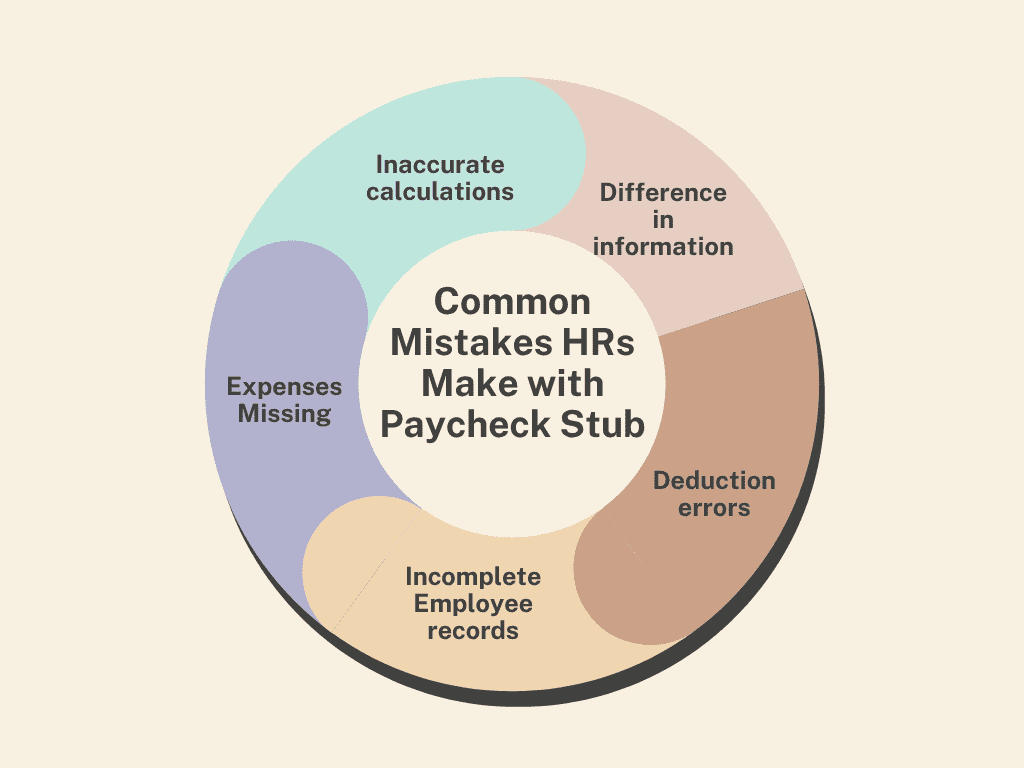

An AI paystub generator can be an invaluable asset in eliminating common payroll errors, automating calculations for gross pay, taxes, deductions, and net income with greater accuracy and consistency than traditional methods.

The AI payroll software works by gathering payroll-related information and compiling it into a pre-designed free paystub template. Users provide details such as employee or contractor data, employer details, pay rate, salary or hours worked, work hours completed, and any deductions.

Once submitted, the system processes it and automatically organizes it into a professional paystub format. Built-in templates ensure all relevant payroll fields, such as earnings, taxes, and net pay, are in their respective sections.

As soon as a paystub is generated, users can instantly review and download it in a convenient PDF format for use as income verification, personal records, or business documentation. This makes the process fast and hassle-free for anyone who requires pay stubs for income verification, personal, or corporate documentation purposes.

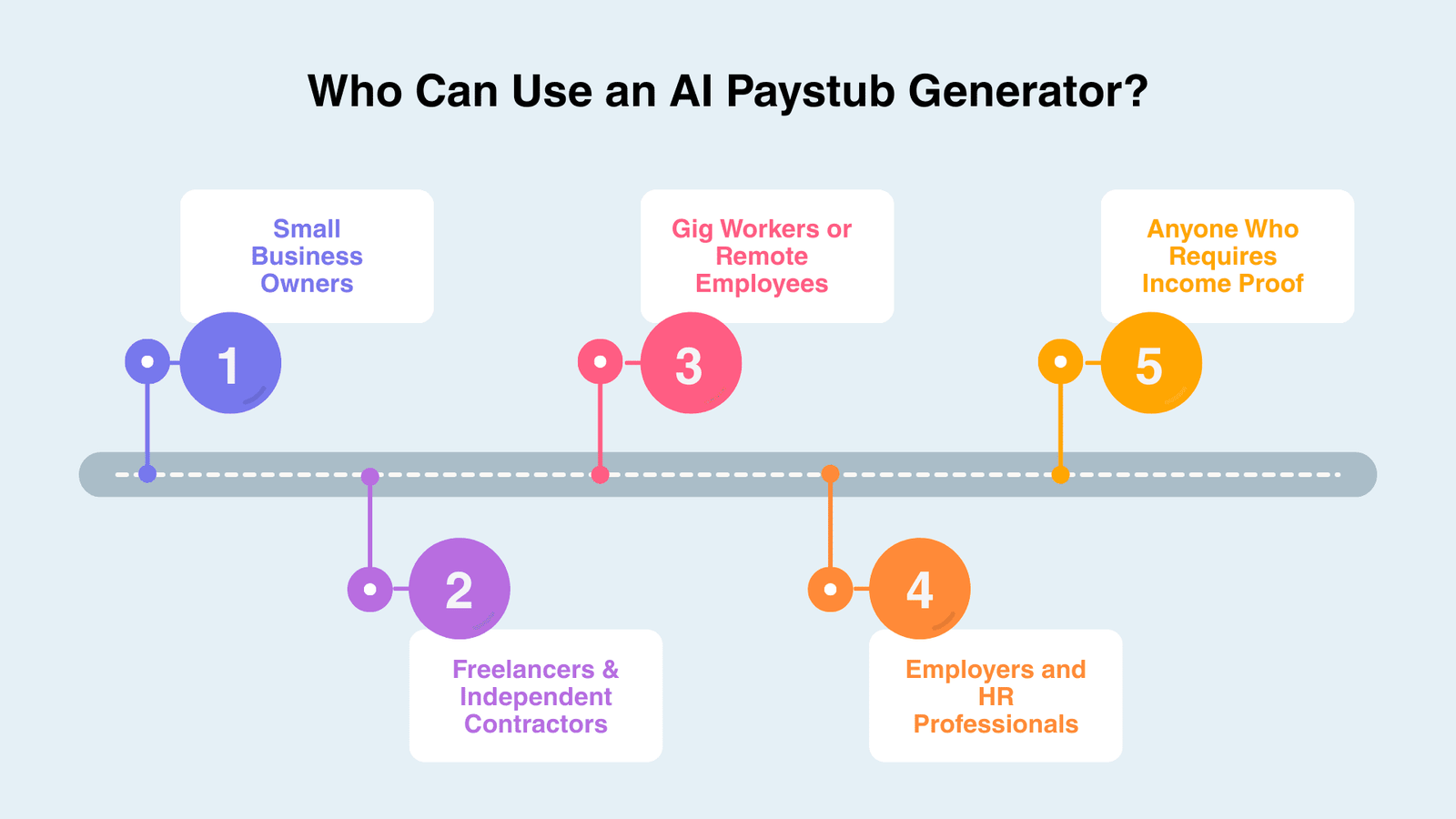

Who Can Use an AI Paystub Generator?

An AI paystub creator can serve AI paystub generation to a wide variety of users who require accurate payroll records quickly, without managing an in-depth system.

-

Small Business Owners

AI paystub generators offer small businesses without a dedicated payroll department an efficient and accurate method for creating employee paystubs quickly and consistently.

-

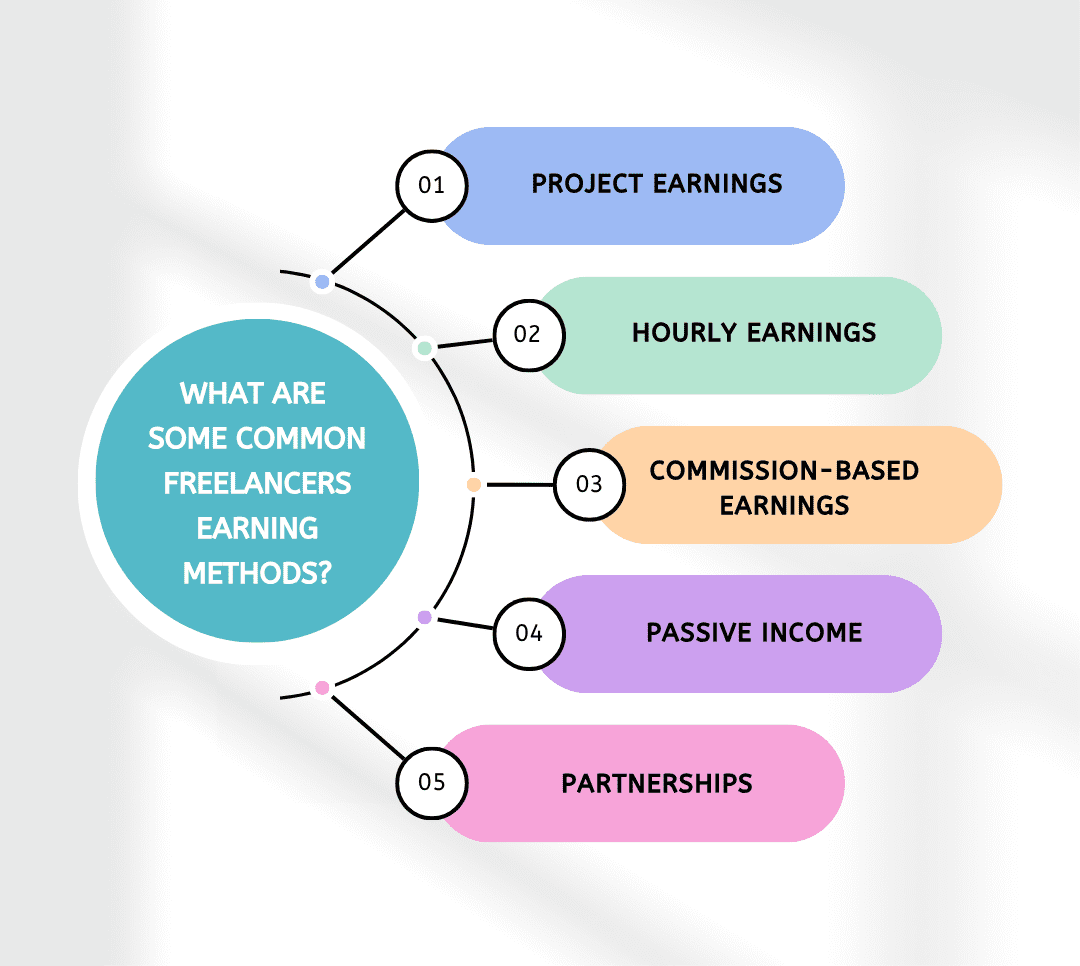

Freelancers and Independent Contractors

Self-employed professionals require pay stubs for income verification, tax preparation, or personal records. The free AI pay stub generator enables them to quickly generate reliable pay stubs without hiring an accountant or using complex payroll software.

-

Gig Workers or Remote Employees

Individuals employed remotely often need proof of income when applying for loans, renting apartments, or providing financial documents. AI-generated paystubs provide an efficient and quick solution.

-

Employers and HR Professionals

Businesses requiring immediate payroll documentation for audits, employee requests, or internal records can take advantage of AI paystub generators’ quick and efficient output.

-

Anyone Who Requires Income Proof

Whether it is financial applications, employment verification, or personal use, anyone in need of legitimate proof of income can rely on AI paystub generators.

Overall, the best free AI paystub generator is an economical and time-efficient solution to produce accurate paystubs quickly.

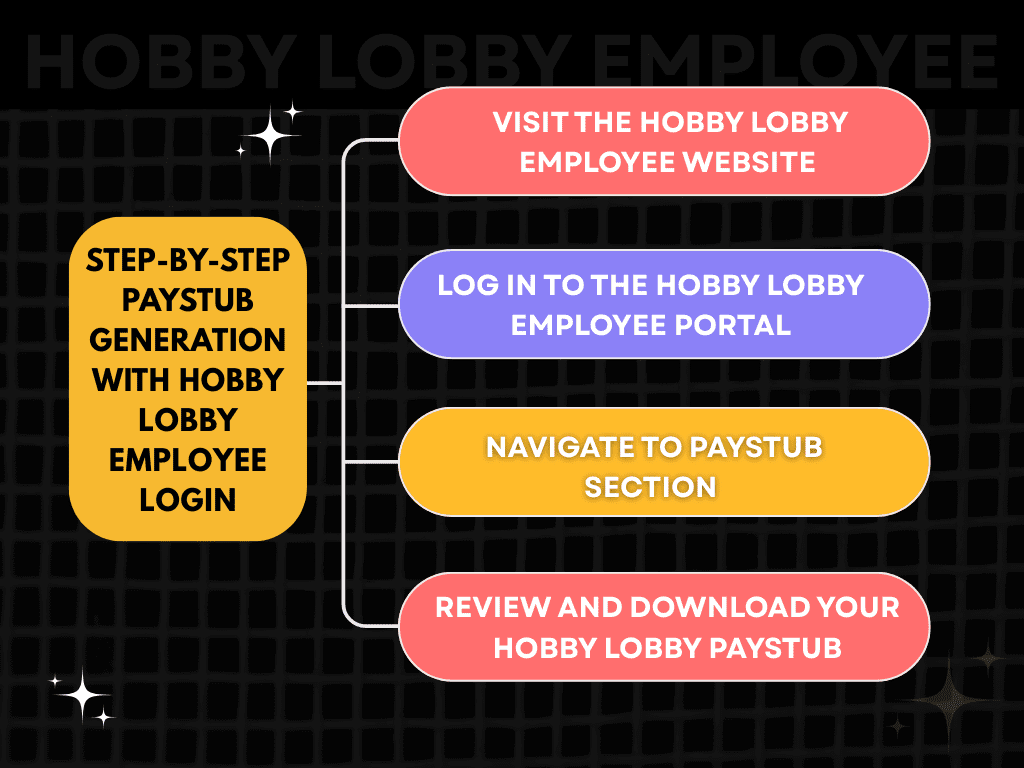

How to Get Started with an AI Paystub Generator Free Tool?

If you are using the Paystub Generator Free tool that provides a straightforward process that delivers accurate results quickly. No payroll knowledge or technical know-how are needed, just the proper information.

Step 1: Fill Out Basic Pay and Personal Details

First, fill in all essential details including employee or contractor name, employer details, pay rate/salary amount/period and any deductions that might apply. The form is straightforward and user-friendly for easy completion.

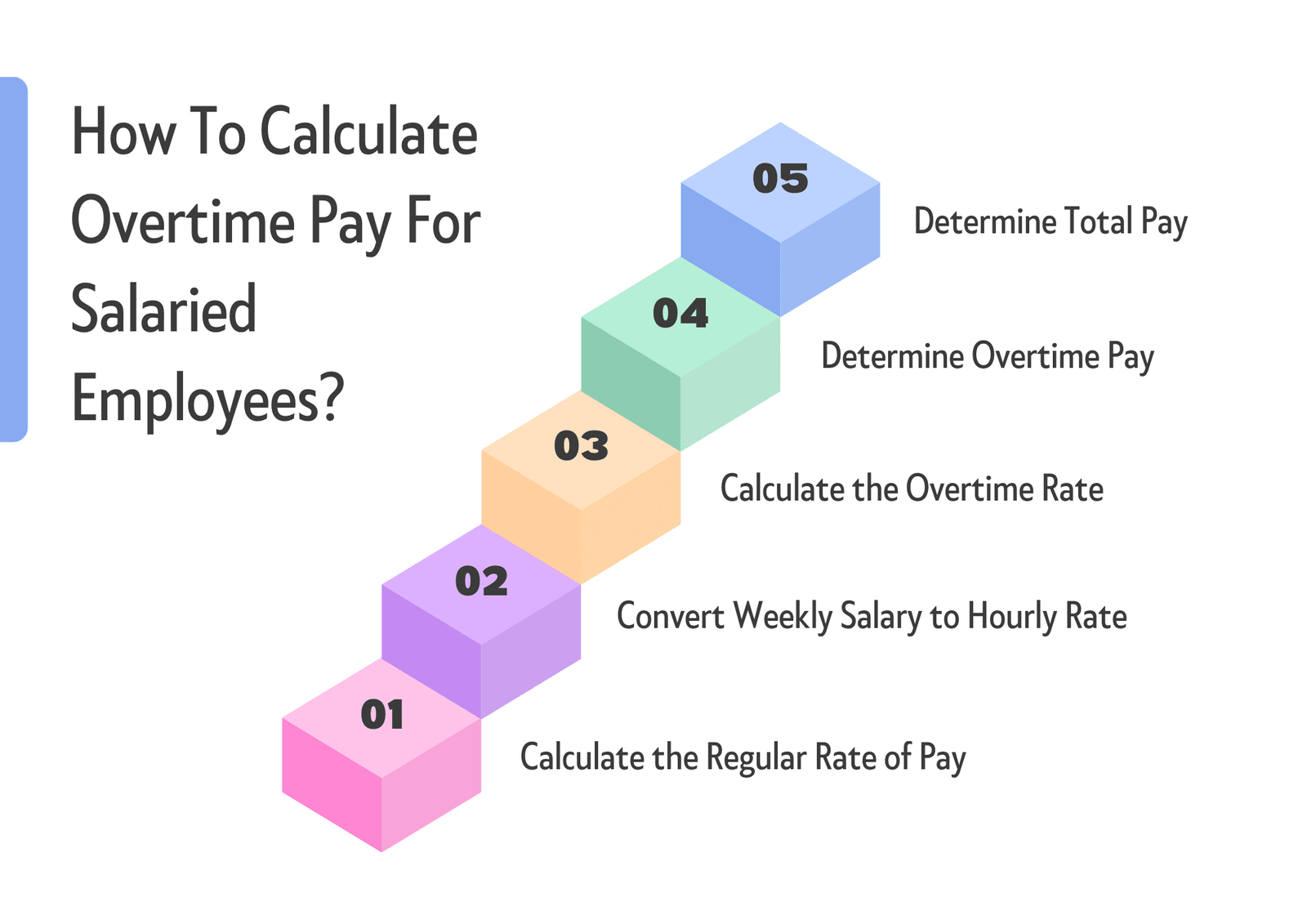

Step 2: Automated Payroll Calculations

Once information has been submitted, the automated paystub generator instantly calculates payroll figures based on income details, current tax rules – including federal and state taxes, Social Security wages, Medicare deductions, and any applicable deductions; eliminating the need for manual calculations.

Step 3: Paystub Formatting and Verification

The paycheck stub generator then compiles all of your information into a professional, standard paystub format with every field correctly placed ensuring an official document that looks accurate, clear and reliable for official use.

Step 4: Download Your Paystub Instantaneously

Once a paystub has been generated, it can be downloaded immediately in PDF format for immediate use as income verification, loan applications, rental agreements, employment records or personal documentation.

Final Thought

AI paystub maker has made creating paystubs much faster, simpler, and more accessible for employees, freelancers, and small business owners. Through smart and free paystub templates and automated processing, these tools are helping create clear professional paystubs in minutes!

No matter your reason for needing paystubs – whether for proof of income, personal records or business documentation – choosing an efficient Payroll stub generator is paramount to their use. Reliable platforms like Paystub Generator Free enable you to confidently create paystubs while saving both time and effort in the process.

Are you struggling to make accurate paystub?

Are you one who is struggling with payroll calculation, accurate net pay, and deduction! If you find this more error prone task then create your paystub with Paystub Generator Free!

Frequently Asked Questions

-

Can AI create paystubs?

Yes, AI can create paystubs by organizing user-provided payroll details into an organized and professional format. You just need to provide the details you want to add in paystub, then AI paystub generator make the paystub by using artificial intelligence.

-

Can chat gpt make pay stubs?

No, ChatGPT cannot generate official or legally valid paystubs; however, it can provide sample content or explanations.You can make for your own record keeping purpose.

-

Can landlords detect fake pay stubs?

Yes, landlords can detect fake paystubs by verifying employer details, verifying inconsistencies between paystubs or requesting additional income verification documents.

-

What is the best free paystub creator?

A great free paystub creator provides accurate calculations, professional templates and easy downloads without hidden fees or unexpected costs. You can make your paystub by using the Paystub Generator Free tool.

-

Can AI make me a pay stub?

AI paystub generator tools can assist with creating paystubs by processing entered details and formatting them properly. You just need to add details and get the detailed paystubs.

-

What’s the best free paystub generator?

The ideal paystub generator should be easy and accurate, enabling instant downloads of paystubs – such as Paystub Generator Free.

-

Are pay stub generators legal?

No, paystub generators are legal if used to produce accurate payroll records; using them fraudulently would constitute fraud and therefore constitute illegal use.