Why Self Employed Individuals Need a Pay Stub?

A pay stub serves as an income proof for self-employed individuals but can also provide clarity, credibility, and professionalism to their work. They do not get self employed pay stub easily, and so it becomes important to provide each individual a record for the purpose of effective financial accountability and the proof of income.

Self employed paycheck allows the them to outline their income, expenses, and profitability accounting relative to their business. Self employed pay stub offers a more helpful way of looking at business and home accounting when audited by an accountant.

Providing a self employed paycheck upfront to clients also portrays professionalism because of their potential to project the self-employed person’s business as organized, legitimate, and credible. A self employed pay stub can also help instill confidence or trust from a client.

Common Use Cases for Self employed Pay Stub

- Apartment Leases: A Landlord may ask for evidence of a steady income before signing your lease to anyone.

- Loan Management: Lenders will require your check stub for self employed person to validate income to ensure financial credibility.

- Tax Preparation: Self employed check stub make tax preparation easy by showing your gross income, deductions, and what is withheld, all on one form.

- Legal Proof: During any settlement, income proof may be requested for child support payments or other reasons.

- Insurance Applications: Health or disability insurance may also ask for your pay stubs for eligibility and premiums.

Self-employed professionals might have trouble getting loans, housing, or insurance without free self-employed pay stubs. They might also have trouble with tax and legal paperwork. In summary, pay stubs support both personal and professional objectives, help meet compliance requirements, and provide financial organization.

Benefits Of Having Self Employed Pay Stub

Having a self-employed pay stub provides credibility, simplifies financial management, and makes income verification easy for personal, professional, and legal needs.

Customizable for everyone

Self-employed pay stub can be personalized to include things like the name of your business, wages, taxes, deductions, etc. There are many ways to configure a self employed pay stub template so you can make it truly reflect who you are, regardless of whether you are a freelancer, contractor, or small business owner.

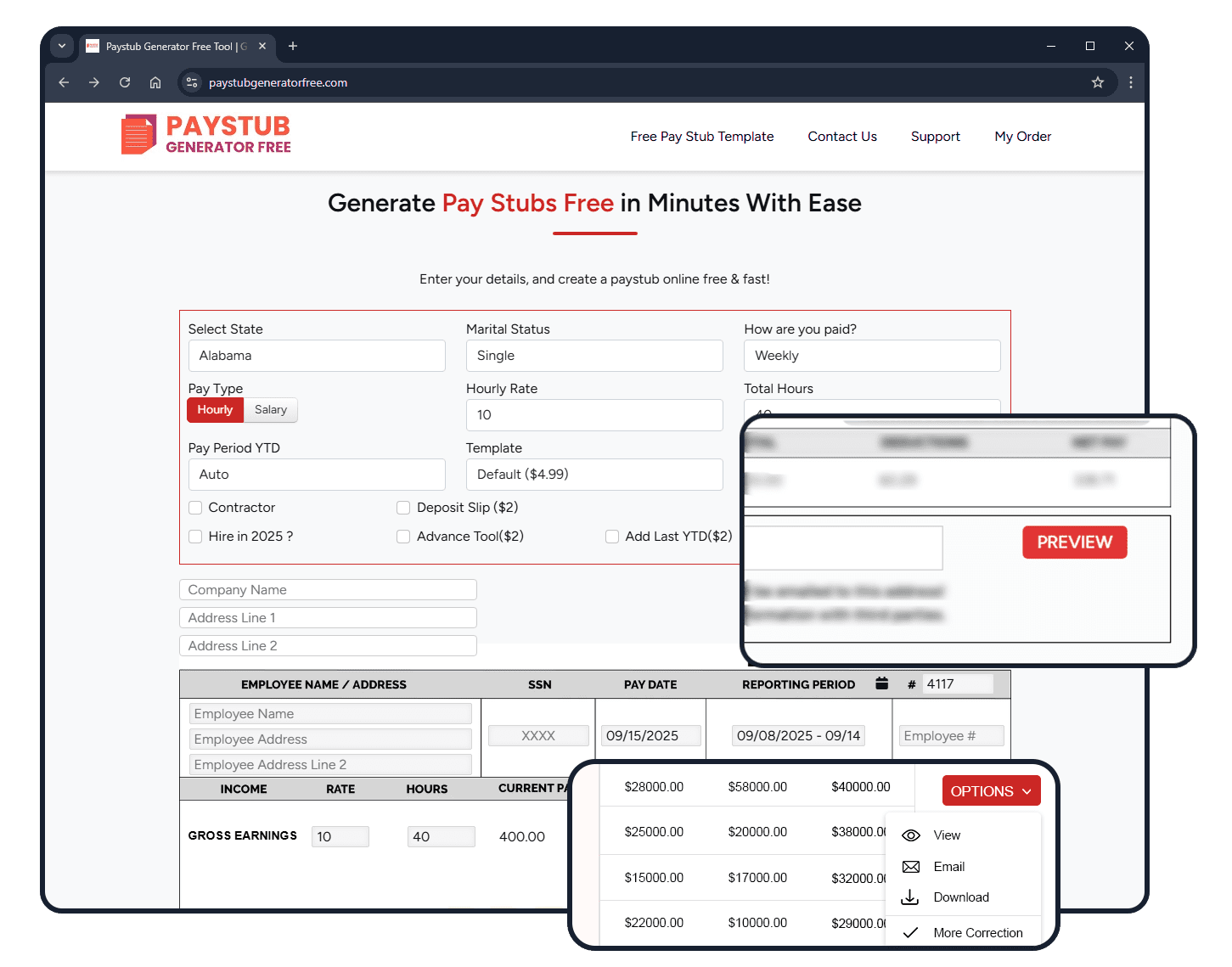

1st stub free

Most online paycheck stub generator tools let you create your first stub for free so you are able to test the accuracy and functionality of the pay stub prior to placing your order. This is a cost effective method to find out how viable they are for your document when there are no unreimbursed expenses.

Accurate calculation

The automatic self employed pay stub generator ultimately calculate your wages, taxes, and deductions in accurate way’. You are eliminating human errors in calculation, therefore you can keep track of your wages accurately. Most importantly, it helps keep your financial records accurate and trustworthy when dealing with loans, taxes and financial planning.

Free self-employed pay stub template

Free self-employed pay stub templateare the quickest way to create a professional pay stub. A free self employed pay stub template is time-saving and cost-effective and uses a professional format that usually will meet all financial needs.

Get free correction

If errors occur, a Paystub Generator Free offers free corrections to ensure accuracy and compliance. This feature adds convenience and peace of mind, letting you maintain professional financial records without extra cost or hassle.

Round The Clock Support

From creating stubs to fixing errors, 24*7 hours support helps to quickly resolve problems. Self-employed people can get professional advice at any time with our experts, which guarantees seamless financial documentation and a stress-free income record management experience.

Difference Between Salaried Stub And Self Employed Stub

Most salaried people automatically have a paycheck with a pay stub, but that’s not typically the case for self-employed individuals. But there are numerous reasons you can need self employed check stub like when you’re applying for a mortgage, credit card, or rental property. That’s where making your own pay stub becomes useful.

Key Differences in Self-Employed Pay Stubs

A self-employed pay stub appears almost identical to an employee’s pay stub, but there are some points to consider:

- Company and Personal Information – This part doesn’t change and will display your name, business name, and other identifying information.

- Pay Period & Amounts – As the income of self-employed individuals is usually project-based, pay periods and sums do not necessarily follow a predictable pattern.

How To Make A Pay Stub for Self-Employed People?

Making a pay stub as a self-employed person is straightforward with an online generator. Just follow these steps:

- Decide if you are creating the pay stub for an employee or for yourself.

- Select a self employed pay stub template.

- Enter your details, such as name and address.

- Add your company information, including business name and address.

- Enter income information, such as hours worked, compensation, or payment against a project.

- If deductions or withholdings apply, include them.

- If its first stub, Make the payment, and download your pay stub immediately.

The self employed paycheck is official proof of earnings and will help you obtain loans, qualify for tenancy, or maintain financial records with ease.

Turn self employment income into verified proof with paystub!

Generate the paystub in fast, easy & reliable way with Paystub Generator Free

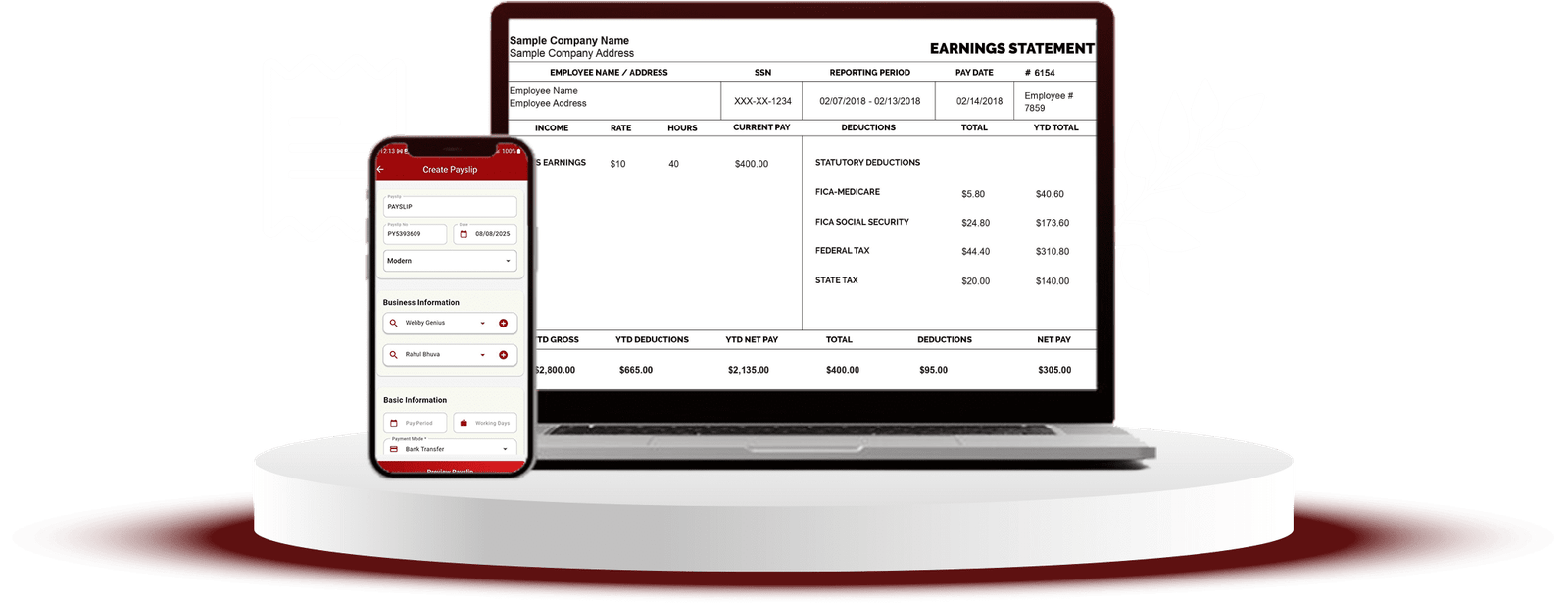

Pay Stub Template For Self Employed Individuals

FAQ's

A self-employed pay stub is a record of your earnings, net pay, and deductions. It serves as official proof of income for small business owners, independent contractors, freelancers, and self-employed people.

Pay stubs, tax returns, invoices, bank statements, or signed contracts are examples of documentation proving self-employment income. These records attest to your income in order to grant credit, lend money, or rent.

Paystub generatos make it easy for independent contractors, self employed people to create their own pay stubs. These pay stubs are valid evidence of income, which is helpful for financial verification, loan applications, and housing approval.

You can also use invoices, bank statements, profit-and-loss statements, or tax returns as evidence of your self-employment income if you don’t have a pay stub.

Self-employment income proof can be provided using pay stubs, tax returns, bank statements, or invoices. Pay stubs are the most professional and convenient way to verify quickly.

By entering your personal information, income, deductions, business name, and other details in a pay stub creator, you can generate your own pay stubs online and then download a professionally prepared stub.

Alternatively, if you do not have a pay stub, you can use tax returns, profit-and-loss statements, bank statements, or invoices as proof of your self-employment income.

Pay stub generators are mostly utilized by independent contractors in creating precise stubs. This gives them professional proof of income for tax, rental applications, and financial purposes.