Why Professional Paystubs Are Crucial for Business?

As firms face a high demand for complex payroll processes and the need for accuracy and compliance, the demand for professional pay stubs is multiplying. Businesses must prioritize having a caring payroll team to maintain financial health, ensure compliance, and support growth in the sector.

A professional pay stub is the backbone of any business. It involves far more than just calculating salaries; it ensures that the employees are paid accurately and on time, taxes are filed correctly, and legal regulations are adhered to.

How Paystubs Benefit Both Employers and Employees?

Professional pay stubs are beneficial to both employees and employers in the following ways:

- Transparency: Pay stubs provide transparency in understanding how their gross pay is calculated and what deductions are being made. This will help employers avoid future issues with the government and other parties.

- Streamline Payroll: A detailed pay stub can help the employer save time by reducing the number of questions employees have about their pay.

- Resolve Disputes: A pay stub is used to resolve any disputes which might arise.

- W-2s Preparation: A professional pay stub is helpful for employers while preparing each employee’s W-2s Form.

- Meeting the Legal Requirements: Some states require employers to provide pay stubs to employees and specify what information should be included in a pay stub.

Challenges Faced by Small Businesses in Generating Paystubs Manually

Below are the challenges faced by small businesses while generating pay stubs manually:

- Incorrect Personal Information: It is essential to work with inaccurate personal information on a pay stub. Any inconsistencies, like a wrong name, address, or Social Security Number, will lead to a powerful problem, which includes tax issues and complications with employment records.

- Incorrect Working Hours: You should always double-check the number of hours stated on an hourly employee’s pay stub. Discrepancies between the actual working hours and what’s reported can affect the final pay.

- Inaccurate Wages: Errors occur when calculating the base pay, especially if the wage changes.

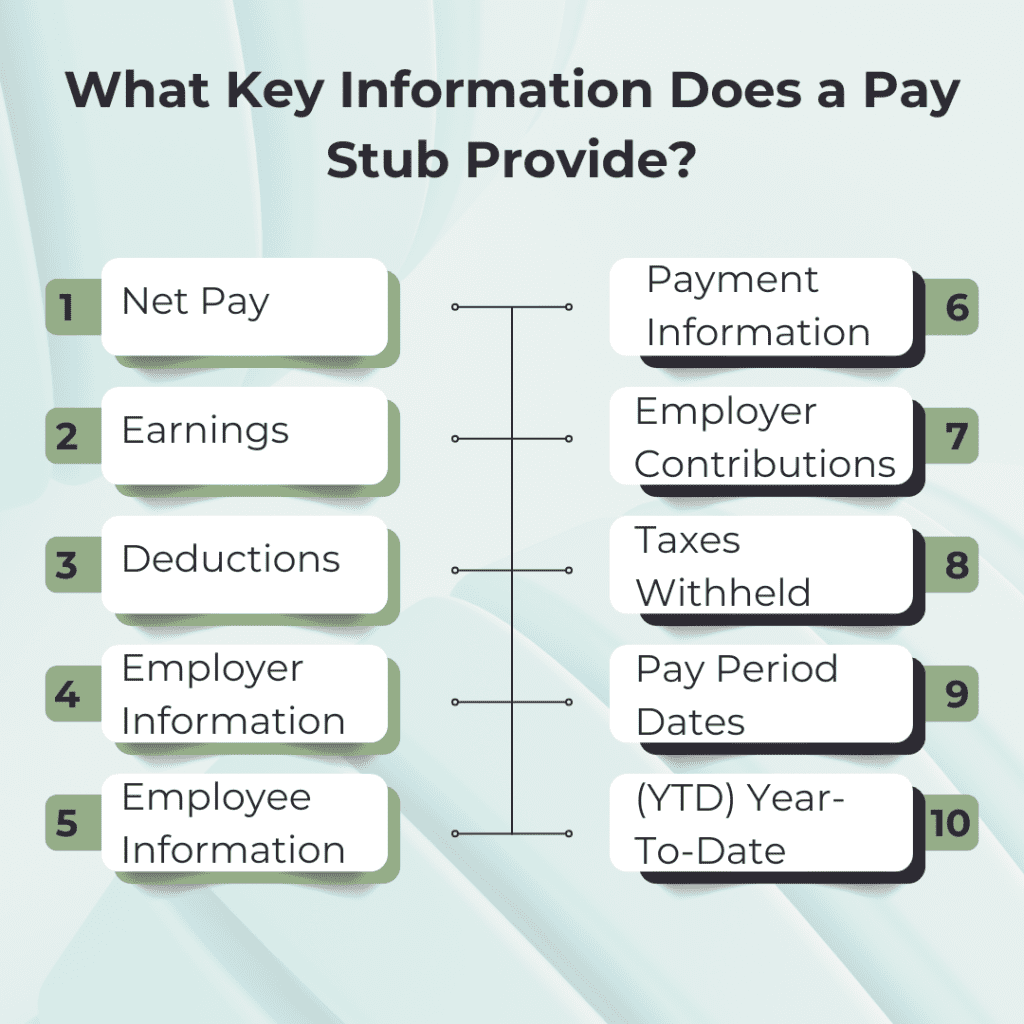

What Information Should Be Included in a Paystub?

The top of the pay stub displays the employer’s name and address, the beginning and ending dates of the pay period, and the employee’s and the employee’s name and address.

The pay date is the actual day that the employee gets paid, and the pay period is the length of time the pay date covers.

- Gross Wages: The total amount an employee earns before any deductions are taken out.

- Net Pay: This is the amount that you take home after all deductions have been deducted.

- Deductions: The amount that is deducted from the gross wages, such as taxes, benefits, and retirement contributions.

- Federal Tax: The federal income tax deducted varies based on your earnings in accordance with federal laws. The more you make, the higher the rate of taxation. The minimum federal income tax rate is 10%.

- State Tax: The state tax deduction varies from state to state. For example, Florida has no state income tax. California, the state with the highest state income tax, has a rate of 13.3%.

- Other Taxes: Depending on your location, you might observe deductions for local income taxes from your pay. Cities like Chicago have a high local tax rate, while other localities have no additional taxes at all.

- Employee Benefits and Withholdings – Healthcare Benefits: This includes standard healthcare such as health insurance and vision plans.

- Employee Benefits and Withholdings – Retirement: Retirement benefits mainly consist of leave encashment, retirement bonus, and the amount that employees contributed to their provident fund account throughout their service.

The Risks of Using Inaccurate or Unprofessional Paystubs

- Legal implications of inaccurate paystubs: This refers to the potential violation of labor laws, tax regulations, and other legal obligations, which can rise due to pay stub errors. These implications can result in legal actions or penalties.

- How can errors impact employees’ financial records?: If the inventory errors are overstated, this will result in an overstatement of gross margin and net income. Also, the overstatement of ending inventory causes current assets, total assets, and retained earnings to be overstated.

- Building trust and transparency with employees: Pay stubs offer employees a transparent view of their wages, deductions, and net pay. Employees can understand how their taxes, insurance, or other deductions will impact their take-home pay and create paystubs for their records.

Step-by-Step Guide: How to Create Professional Paystubs in Minutes?

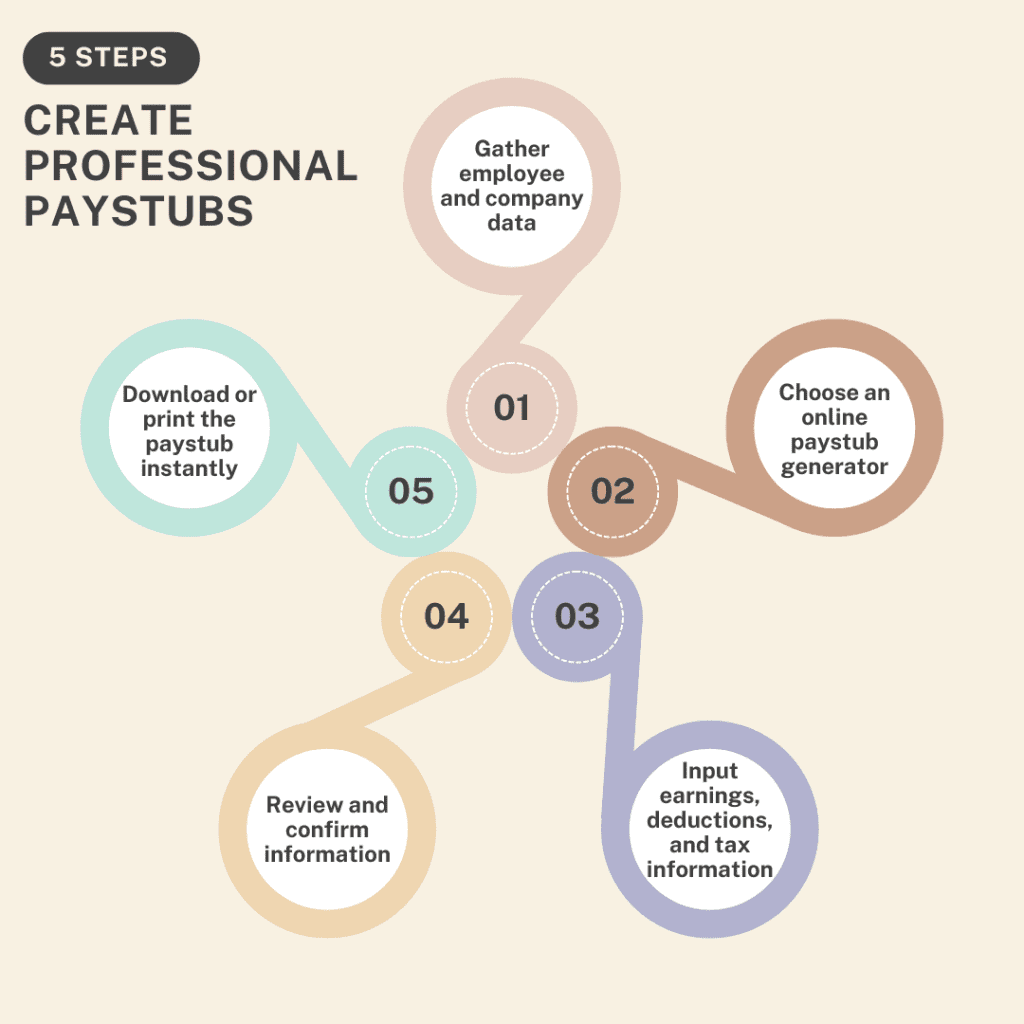

- Step 1: Gather essential employee and company data: You should gather essential employee and company data to insert the data.

- Step 2: Choose an online paystub generator or accounting software. Select a reliable paystub generator that you trust to do the job for you.

- Step 3: Input earnings, deductions, and tax information: Insert earnings, deductions, and tax information to fill up the required information in the form.

- Step 4: Review and confirm the accuracy of all information. Once you’ve completed the form, go through it thoroughly.

- Step 5: Download or print the paystub instantly: Click on the download button to download a professional paystub and print it for your records.

Benefits of Using Paystub Generators

- Time-saving benefits: Generate Paystubs in Minutes: With a pay stub generator at your disposal, your work gets much easier than the manual paystub process.

- Ensuring Accuracy with Automated Calculations: Minimizing human errors via automation can help prevent costly mistakes, such as incorrect deductions, saving you from penalties.

- Compliance with Labor Laws: A pay stub generator will automatically fill in the information based on the jurisdiction’s requirements.

- Proof of Income: A professional pay stub is used as proof of income when applying for loans.

- Financial Planning: A pay stub can help employees track their income and expenses, which is crucial for budgeting purposes.

Key Features to Look for in a Paystub Generator

- User-Friendly Interface: An easy-to-use interface can save you time and errors. Whether you’re an employer creating multiple pay stubs or an employee generating a single stub, the process is easy.

- Customizable Templates: Different types of businesses have different needs, and a trustworthy pay stub generator offers customization options to cater to these variations.

- Accuracy and Compliance: Errors in a pay stub can lead to legal issues, employee dissatisfaction, and financial discrepancies.

- Accessibility and Convenience: A reliable pay stub generator is accessible from various devices and can be used anywhere, anytime.

Key Takeaways

Generating paystubs for employees is essential for accurate record-keeping and for fostering trust and transparency in your organization. With the right tools and a streamlined approach, generating detailed, accurate paystubs can be done in minutes.

Utilizing modern payroll software, maintaining consistent formatting, and ensuring all necessary details are included, such as earnings, deductions, and tax information, can make the process efficient and professional.