21% of the workers are unhappy because not everyone knows what is on their pay stubs. This issue arises because pay stubs are difficult to read.

Employees get the correct information about payment from those working in the HR department. Clean pay stubs with error-free details is when the HR is able to maintain a perfect record of their pay stubs.

This guide will help you understand everything about a pay stub and what HR needs to know about it.

Paystub explanation for HRs

A pay stub helps HR as it acts as a clear record of an employee’s earnings, deductions, and net pay. HR paystub document helps them in maintaining accuracy by making sure that taxes and deductions are calculated correctly.

They improve transparency by helping employees understand how their payment was calculated, as well as reducing any confusion based on pay stub queries.

Generating a pay stub through a payroll stub generator isn’t just a daily routine; it is about maintaining trust and transparency with employees, and it is also about displaying professional ethics in each detail.

The details help employees to understand how much their net pay was figured from their gross pay. It serves as a record for earnings status and any withholding, like taxes and retirement contributions.

An accurate and professional pay stub plays an important role in the HR department by providing them with detailed information about their earnings and deductions.

What does a paystub look like?

A pay stub is a detailed version of the document that provides a full breakdown of an employee’s earnings and deductions. It includes various sections to display different types of information, like employee details, deductions, and net pay.

A professional paystub can be generated using the Paystub Generator Free tool. A pay stub can vary in appearance as well as in font type, making it easy to read and understand.

Components Included in Every Pay Stub

A Paycheck Stub has various pieces of information that help both the employer and employee understand and keep track of earnings and deductions. Below is what gets included in a pay stub:

Employee information:

- Employee name

- Employee identification number

- Social security number

- Pay period

- Pay rate

Earnings information:

- Gross pay: The total amount of money that the employee has earned before any deductions are made, which includes overtime pay, bonus, and other earnings.

- Hours worked: Total number of hours worked in the pay period, which is then broken down into regular hours.

- Overtime pay: Additional pay for hours worked over the working week, which is calculated at a high hourly rate.

- Year-to-date earnings: The total gross earnings that start from the year’s beginning to the current pay period.

Why HRs Must Provide Pay Stubs?

For keeping a clear record of your pay stubs, employers and HR can keep up with the labor law regulations. They provide a full breakdown of wages, taxes, and deductions. With the help of the Pay Stub Template, you can choose a template of your choice and create a professional pay stub.

This healthy practice not only protects the employers from getting into legal trouble but also provides employees with the guaranteed assurance that their rights and payment obligations are protected.

A detailed Pay Stub and Pay Slip can help in assisting with any kind of discrepancies in the payment. It serves as a record of payment, which also resolves differences immediately.

Transparency in financial reporting boosts the workplace’s morale and also contributes to the environment of the organization.

By using a check stub generator, one can easily simplify the process of paystub creation. With this method, firms can reduce human error as well. This method saves time and can be redirected to other vital tasks.

A Paycheck Stub has an important part to play in contributing to the HR department and employees’ well-being.

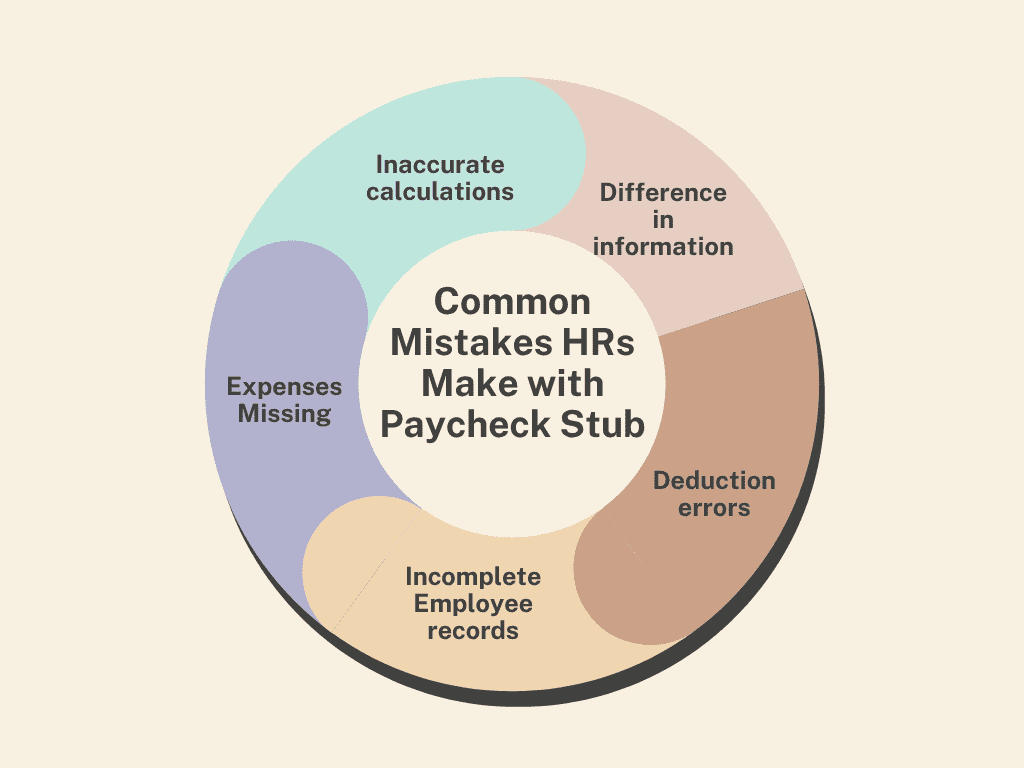

Common Mistakes HRs Make with Paycheck Stub

The most common mistakes HRs make with a Paycheck Stub are:

Inaccurate calculations:

Wrong calculations are the kind of mistakes that might go unnoticed. This happens while organizing the numbers to showcase the wages of an employee. Regarding an hourly employee, calculation errors might happen. This error may lead to incorrect calculation of overtime wages that are to be paid.

Difference in information:

This mistake in a pay stub is the most common of them all. This is the most basic mistake that comes into consideration. An incorrect name is another issue. But an incorrect ID number can cause a lot of trouble with the tax system.

Deduction errors:

This deduction error on a pay stub may showcase employees who have the wrong amount deducted from their pay. Employees have an incorrect amount deducted from their salary, so there might be occasions like such where various deductions can be eliminated.

Incomplete Employee records:

In case you are trying to manage the employee records in addition to the basic role, you know how easy it is for errors to appear. A pile of paper and various spreadsheets does not make up an accurate record of the paystub system. Mistakes happen, and it is a nightmare for HR to track them down and fix them in one go.

Expenses Missing:

It is a common thing to forget about writing down the expenses if they aren’t documented properly on a pay stub. This can lead to errors in data entry or employees filing out their expenses very late.

Being an HR, are you struggling to find a trustworthy paystub generator for your business?

Keep an eye out for the PayStub Generator Free, which helps in creating free stubs.

Why HRs Should Use a Paystub Generator Free Tool?

An HR professional can use a paycheck stub generator to save time, improve efficiency and accuracy, as well as enhance legal compliance and transparency with the employees. Below are some reasons why HR should use this tool:

Enhanced Efficiency:

Manually creating pay stubs for a large organization is a time-consuming task. A payroll stub generator automates calculations for taxes and deductions, providing professional pay stubs in minutes.

Increased Accuracy:

Human error, like manual calculations, can lead to significant discrepancies and legal issues. Built-in algorithm makes sure gross pay, net pay, and deductions are calculated accurately.

Easy Record-Keeping:

An HR can organize the pay stub history easily without any paperwork. This helps them simplify audits and improve transparency.

Generate Professional Pay Stubs:

Consistently formatting and creating professional pay stubs improves the brand’s identity. An HR can send a pay stub immediately without any changes to it.

Builds a Trustworthy Relationship:

When the generated pay stub is a professional one, employees understand their earnings clearly, and it establishes a trustworthy relationship between HR and employees.

Key Takeaways

A well-documented pay stub process is undeniably the foundation of smooth operations as well as the HR department’s employees’ understanding of their payments and deductions. Through an organized Paystub Creator, employers and HR are able to enhance transparency, reduce the feeling of uncertainty and increase trust in their company.

FAQs

1- Can I create a paystub for free?

By using Pay Stub Generator Free, you can generate professional pay stubs for your business without any issues. With our tool, you can create a detailed stub when you insert your information in the empty field and hit the generate button.

2- Is it legal to create your own pay stubs?

In the case of freelancers, it is legal to create their own pay stubs. A registered entity needs to maintain records to determine financial earnings and taxes accurately.

3- Do banks verify check stubs?

Most of the banks have a verification process to detect fake pay stubs. Banks might cross-verify the tax records to spot some inconsistencies in numbers or employer information.

4- Can I use a job offer as proof of income?

You can use a job offer as proof of employment for as long as it includes earning details. The offer letter has to be paired with another document, but it is at the last call of landlord.

5- Can I buy a home with a job offer?

Yes, absolutely. You can use a job offer for mortgage purposes as proof of employment. But it has to meet certain criteria. In some cases, it might need to be backed by a pay stub.