A freelancer needs to monitor their earnings for each pay period, including gross earnings, social security taxes paid, benefits deductions, and other employee details. They are vital for employers when it is time to calculate salary information, taxes withheld, and net pay to deposit into the staff’s accounts. Freelancers can generate pay stubs using a payroll stub generator.

Freelancers might end up without a payroll stub generator in various circumstances. This can lead to confusion when tax season arrives or when they apply for loans. The payroll generator toll simplifies freelancer’s tracking mechanism by creating professional pay stubs.

This blog focuses on freelancers tracking mechanism of their earnings without a payroll stub generator. You will get an insight into solutions for freelancers without a payroll stub generator and what struggle freelancers faces.

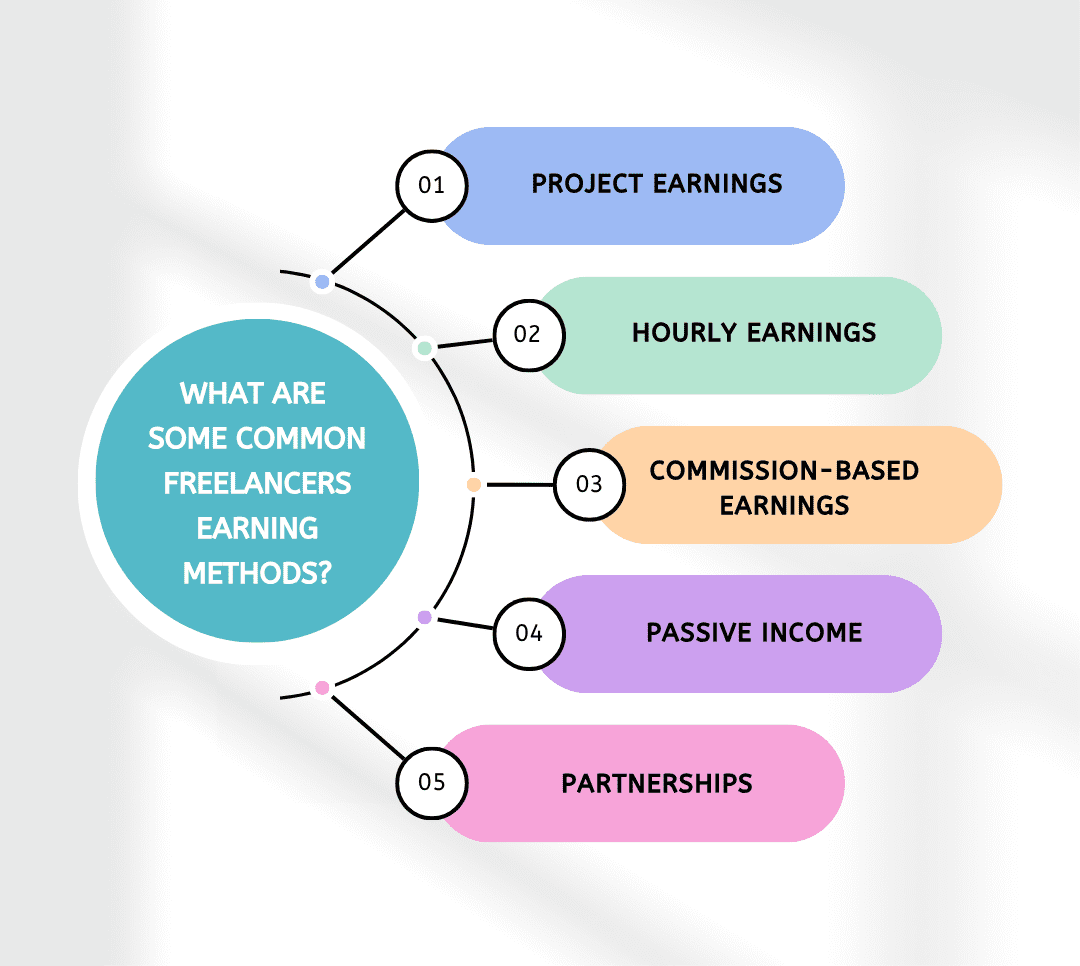

What are some common freelancers earning methods?

The common freelancer earning methods includes:

-

Project earnings:

Freelancers get paid per project. This is one of the top earning mechanism for them. They get projects on platforms such as Fiverr & Upwork. Freelancers set a fixed fee based on the workload and then sign a contract.

-

Hourly earnings:

Freelancers charge as per their working hours. This is a long-term mindset where tasks and projects gets changed overtime. They earn by tracking their timing, making sure that they’re being paid on time.

-

Commission-based earnings:

Freelancers earn a portion of commission through their work. When they work on commission basis, they get a fixed amount of money when their work is completed as per the contractor.

-

Passive income:

Freelancers earn a passive income by selling digital products such as e-books and online courses. This allows them to earn on a regular basis without selling everyday.

-

Partnerships:

In a startup, a freelancer join hands with a firm in partnership and then they might earn a shared profit. Freelancers might earn via referral fees or revenue-sharing contractor. Partnerships not only builds them a stable earning but also helps them in building a network.

Significance of pay stubs for freelancers

Freelancers have to handle everything to by themselves, unlike a typical employee whose firm takes care the paperwork on their behalf. The following is the importance of a pay stub for a freelancer:

-

Record-keeping:

By using a pay stubs maker it gets easier for freelancers to shuffle between multiple clients and keep a tab of all transactions which can be clumsy. Freelancers can update records regularly in order to avoid any delays.

-

Flexibility:

Firms hire freelancers for a limited project to work upon. This allows them to scale their working operations according to their workload and budget. This let them customize their pay stubs details such as hours worked and deductions as per project requirements.

-

Cost effective:

Freelancers work on remotely and on a per-project basis, firms sees the overhead costs for them such as equipments and their benefits. A pay stub generator make sure reports and taxes are intact whenever needed.

-

Freedom of working:

Freelancers get flexible working hours and the power to choose clients as well as projects which align with their skills. Freelancers can work from anywhere without being fixed on a time schedule.

No more struggle to generate paystubs by juggling different clients’ payment stubs!

Create the accurate and professional paysub by using the payroll stub generator without any hassle.

How Freelancers Lose Track of Earnings Without a Payroll Stub Generator?

Freelancers face challenges while managing their earnings if they work with multiple clients. Without proper documentation, keeping track of earnings can become stressful. That’s where a pay stub generator comes in handy.

To generate paystub manually is a time-consuming process and is prone to human error, it makes it easier to lose track of deductions and invoices. Freelancers who rely on manual calculations get their whole calculation wrong, leading to a financial crisis.

Using a trustworthy stub generator such as Paystub generator free which is a well-known tool can help you in simplifying your creation process by providing professional pay stubs for each payment received.

A clean paystubgenerator allows freelancers to create a detailed pay stub in minutes. This not only keeps financial records organized, but it also helps in applying for loans and renting apartments.

Without a tool like a free payroll stub generator, freelancers might find themselves in a spot of bother in order to justify their income and can also miss out on crucial financial updates.

Solution for payroll record-keeping of freelancers with a paystub generator free tool

Freelancers juggle between multiple clients, payment schedules and different income methods. A free paycheck stub maker helps a freelancer in creating pay stubs for themselves and simplifying the process as well as automating record-keeping and making sure professional documentation.

Below we have listen solution for payroll record-keeping of freelancers:

Accurate calculations:

The tool will automatically calculate taxes, deductions and benefits by using the payroll stub generator. All of your complex calculations will be solved within no time.

User-friendly interface:

Pay stub generator free comes with a user-friendly interface where you can navigate easily with no technical experience. In case you’re a non-technical person you too can use this tool to create pay stubs.

Customized templates:

Pay stub templates are designed in a way that it suits each and every user’s occupation. With a variety of templates at your disposal you can choose any template, insert your information and hit the download button.

PDF downloads:

Create a paystub using the paystub generator free and hit the download button and your paystub will be downloaded in PDF format.

Cost-effective:

Being a freelancer, you can save money by using our paystubs generator for all your requirements which gets fulfilled without any hassle.

Key takeaways

A payroll stub generator acts as a life saver tool for freelancers to track earnings, manage taxes and manage finances accordingly. By automating calculations and customizing pay stubs it helps in preventing errors and saves time of your client and yourself.

Freelancers struggle between juggling clients and in multiple payment variations. With the helping hand of a free pay stub creator you can generate professional pay stubs and make sure that the financial records are up to date.

FAQs

1- Why do I need a paystub template?

With the help of a paystub template you can easily insert all of your details into the field and download it in PDF format as well as present it in an organized format. This helps in smooth running of payroll process, saves time and redcues the risk of human error.

2- Can I use an already existing pay stub for tax filing purposes?

Yes, freelancers can use an already created pay stub for tax filing purposes to show proof of income. It is useful when it comes to filing taxes individually.

3- Can I create multiple pay stubs?

By using a paystub generator for free you can create multiple pay stubs. You can rely on this tool as you get instant download of pay stubs in PDF format.