While creating a pay stub for your business, the main workload is on the shoulders of a paycheck stub generator. This tool is useful for both employees and employers in creating professional check stubs for their businesses.

This guide focuses solely on the real-world problems associated with pay stubs and how using a paycheck stub generator can efficiently solve these issues.

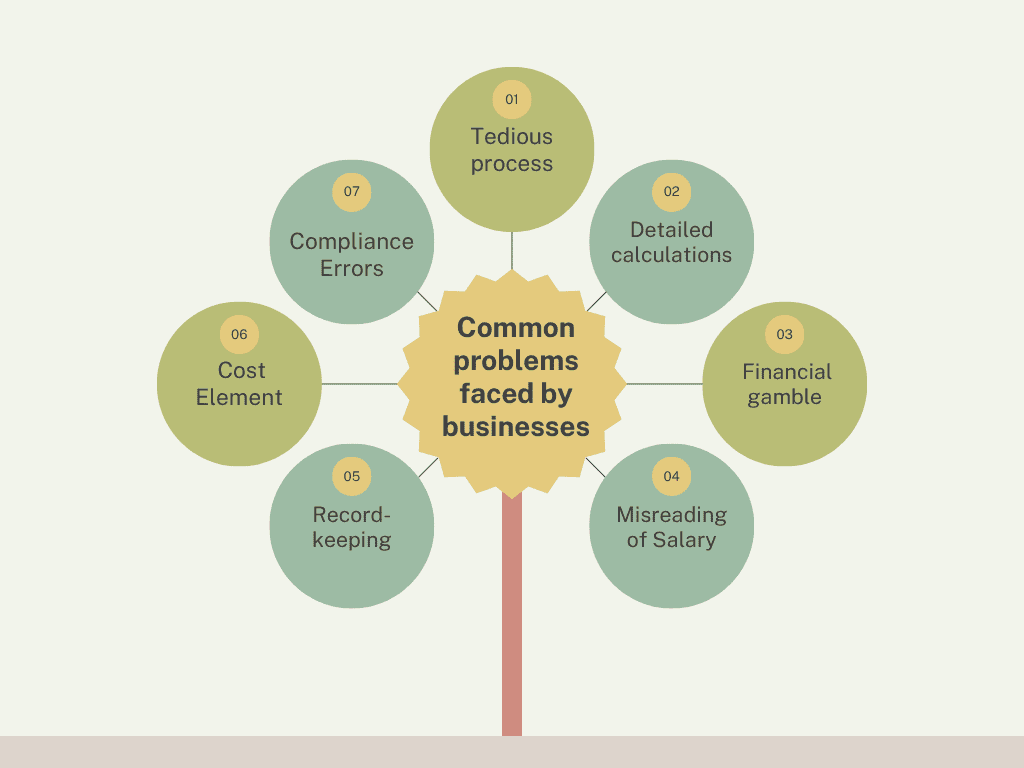

Common problems faced by businesses

Common problems faced by businesses in real life affect the brand image and the status of the company. These problems appear like a speedbreaker in your working schedule, but their consequences are huge, which range from a minor Payroll Register mistake to financial risks. You can easily create pay stubs using our paycheck stub generator.

Let’s make it simple for you and break it down in the simplest way possible:

1: Tedious process

Manual pay stub generation is a time-consuming and tiring process for anybody. In this, you have to calculate gross pay, taxes, deductions, and net pay all manually. But when you use a pay stub generator free for creating pay stubs, it smoothens your workflow process and saves you a lot of time.

2: Detailed calculations

Calculating an employee’s income involves various factors like regular working hours, overtime hours, and deductions. The complex calculations have a 100% chance of human error, and it is a time-consuming process as well.

With the help of a pay stub generator, you can easily calculate your payroll just by inserting your details and ensuring accuracy is followed effectively.

3: Financial gamble

In business, financial risks matter the most. If there is even a minor mistake in generating a paystub, the whole company’s brand image gets affected by it. Errors in taxes, deductions, and miscalculations can lead to huge financial losses.

You can always rely upon a trustworthy paystubgenerator to create pay stubs for your business without any hassle.

4: Misreading of Salary

Manual pay stubs can cause errors in the stubs, leading employees to misunderstand their slips. With a check stubs generator at your disposal, you can easily create pay stubs for your employees without even making a minor mistake in them.

5: Record-keeping

While you keep a valid and organized record of your company’s data, manual processing can lead to errors and loss of data.

A manual paper stub can be misplaced or lost anywhere, and once it’s lost, all your data is gone. In the case of a free payroll stub generator, your data is 100% secure in a detailed, organized manner. Thus, improving the accuracy and management of your data.

6: Cost Element

Manual pay stubs can be a burden, as they consume a lot of time they are prone to error, and an employee cannot focus on other important tasks. With the help of a paystub generator for free, you can eliminate all these factors and get a professional paystub for your business without wasting a penny and a lot of time.

7: Compliance Errors

A compliance error can lead to incorrect tax deductions and overtime calculations. When you use paystubs generator, all of your pay stubs are professional, accurate, and error-free.

Want to get rid of real paystub problems? Use our paystub generator for free, which produces professional pay stubs for you.

Try our free payroll stub generator today and discover how easy payroll can be!

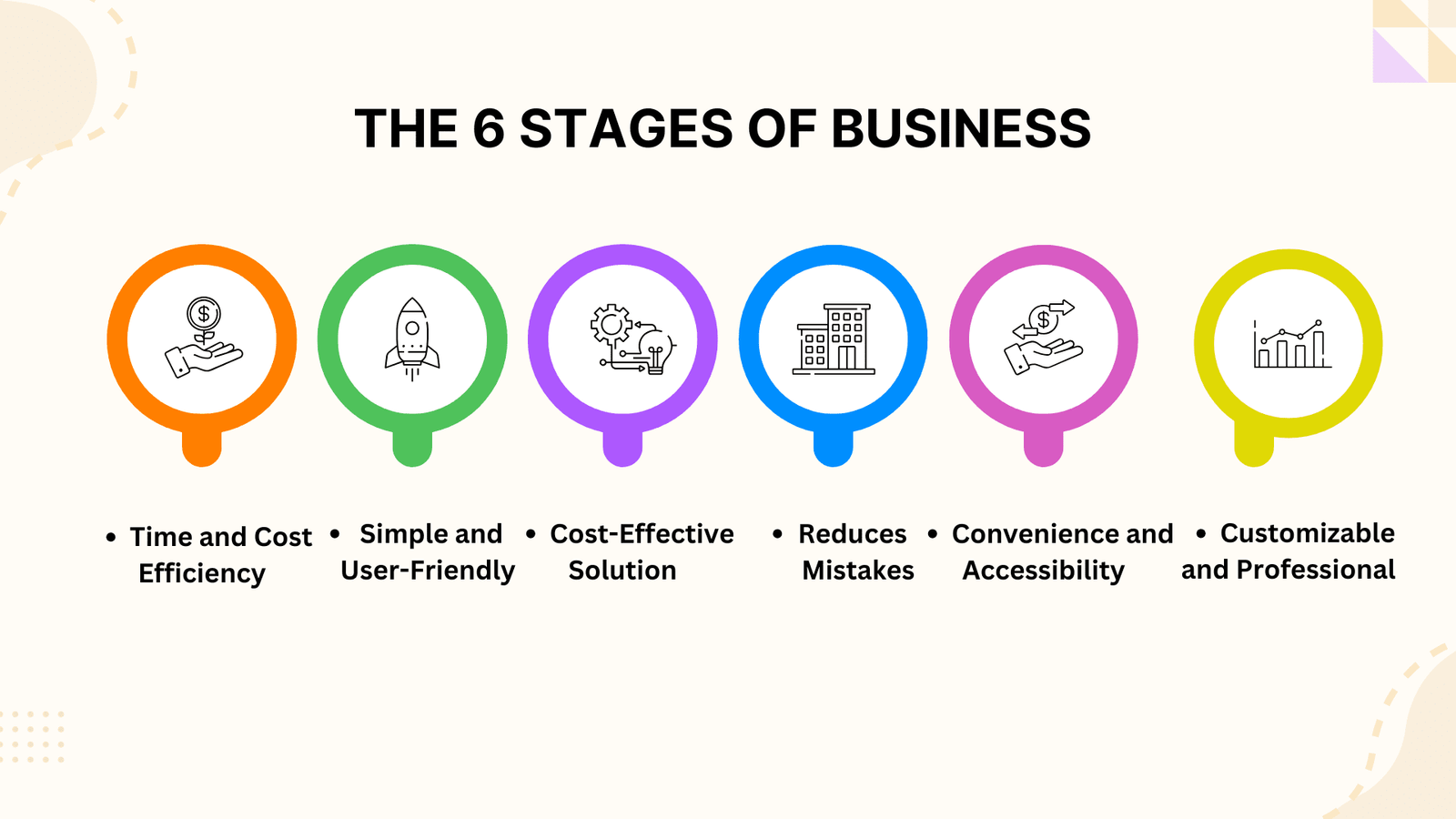

How does a free paycheck stub maker help solve real problems?

A free paycheck stub maker helps users in the following manner:

-

Saves time:

A free paycheck stub maker helps in saving time in calculating taxes and deductions as it automates these calculations, generating professional pay stubs in minutes.

-

Eliminates errors in calculation:

Any kind of error in calculation is eliminated with our paycheck stub generator. All taxes, deductions, and net pay are calculated in an organized manner, which eliminates all errors.

-

Professional record-keeping:

Every transaction is recorded in the system with no chance of error, and it is highly accessible and feasible for the user. Both employees and employers can download professional pay stubs without any hassle.

-

Cost-effective solution:

A check stubs generator is a cost-effective solution over expensive software. A pay stub generator helps in generating professional pay stubs for your business.

Read More : Paystub Generator Free: Your Tool to Break Paycheck-to-Paycheck Finances

Common risks of using an unreliable check stubs generator

The common risks of using an unreliable free pay stub creator, which can put your company at risk, include making the wrong choice. Below, we have described some of the common risks:

-

Wrong information:

Incorrect information on a pay stub leads to incorrect calculation of gross pay, deductions, and net pay. This leads to misunderstanding between the employer and employee. An inaccurate pay stub can also lead to payment disputes and generate confusion in regard to wages.

-

Incorrect Financial Presentation:

Many people use a free payroll stub generator to show rent agreements and other financial documentation. With a stub generator that can’t be trusted, one can generate incorrect information on a paystub, which will have inaccurate earnings listed on it.

-

Data risks:

Some check stubs generator tools do not provide the security needed for safeguarding your data, such as bank details and salary information.

By using a paycheck stub generator, you can generate professional pay stubs for your business.

Read More: Benefits of Using The Paystub Generator Free Tool

FAQs

1- What type of mistakes do people make while generating pay stubs?

Common types of mistakes include incorrect calculations, incorrect financial presentation, and compliance errors on a pay stub.

2- There is an error on my paystub. What should I do?

If you notice even a minor error on your paystub, you should straightaway tell your employer about it. Let them know about the error and save a copy of your paystub as proof.

3- Is it safe to send a pay stub?

Using a secure mode of sending a pay stub, like email, is the safest way to send a pay stub to someone.

Key Takeaways

As per the above blog, there are several real problems that many businesses are facing; however, the problems can be solved by the best solution possible- the Paystub Generator Free Tool.

The pay stub generator free tool helps people to create automated stubs without errors by giving easy and customized pay stubs. Tackle your real payroll headaches, such as errors in tax, manual paystub creation, and the hassle of record keeping, by using our tool.

Try a reliable paycheck stub generator today to see the difference it brings.